Innovative Crypto Trading Techniques Through Understanding Market Dynamics Via Volume Analysis

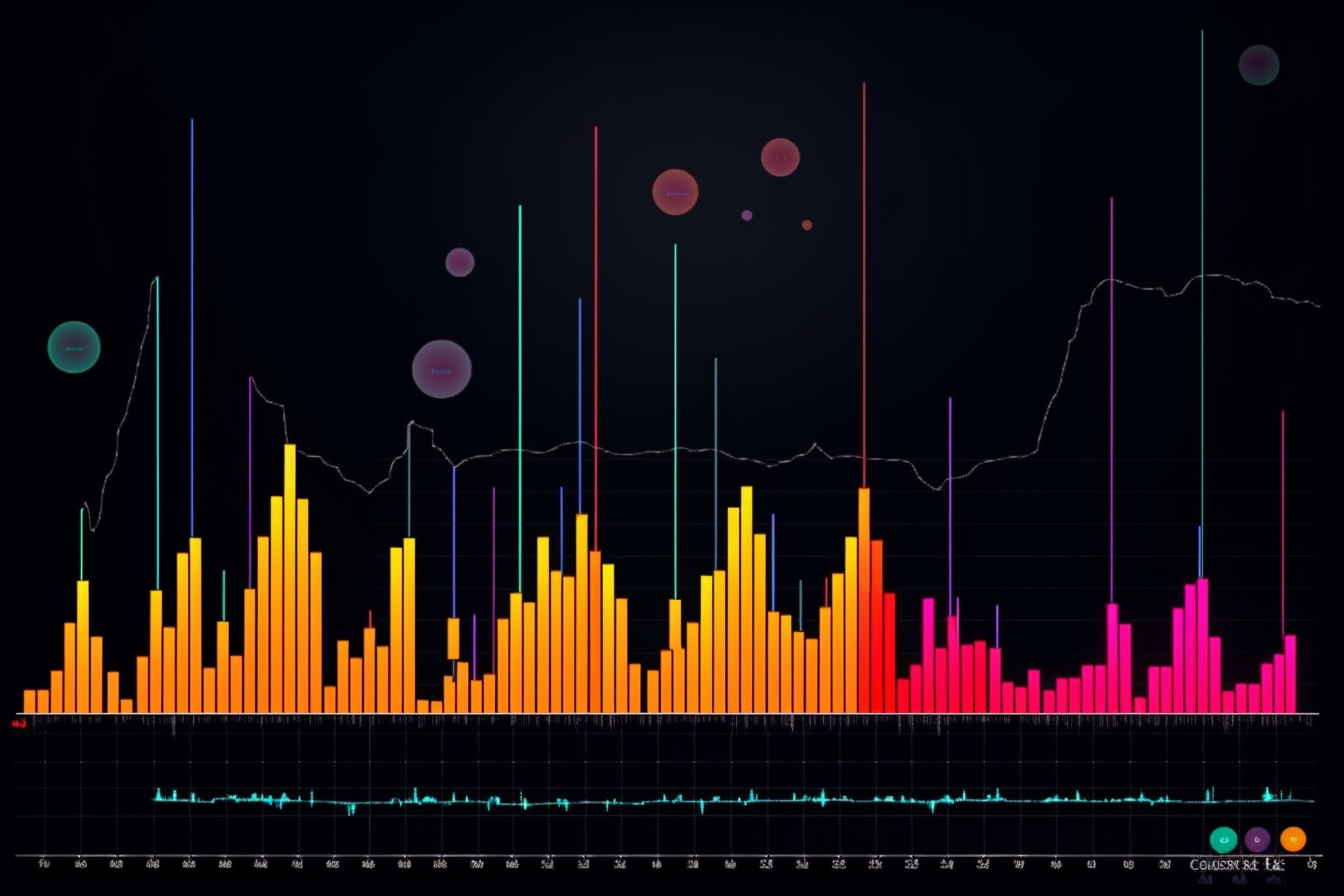

For successful crypto traders today mastering volume analysis is essential to correctly interpreting market dynamics while making sound trade decisions based on those analyses. Trading activity indicators like trading volume are valuable sources which provide important information regarding liquidity levels within markets while also offering clues into a trend's strength and overall market sentiment. This article will discuss the significance of volume analysis by exploring advanced techniques like Cumulative Volume Delta (CVD).

Understanding Cumulative Volume Delta (CVD):

Owning to its inherent ability to track buy orders versus sell orders while calculating their cumulative variance Cumulative Volume Delta(CVD) is a powerful and unique tool that provides unparalleled insight into market strength, detecting trend reversals as well as potential divergences.

Identifying Trend Reversals:

An impressive practical application of the CVD technique is its ability to identify prospective trend reversals - if, for example, price trends showcase higher highs while CVD indicates bearish divergence with lower highs it suggests weakening buying pressure in the market early on presenting traders with ideal warning signals for an upcoming shift in market momentum or possible reversal.

Spotting Market Divergences:

Using CVD can be beneficial in discerning divergences between underlying selling or buying pressure indicated by CVD and price pattern. Such discrepancies occur when there is no correspondence between price direction and volume-based indicators; these instances offer profitable trading strategies into identifying future trend changes/markets movements.

Confirming Price Patterns:

Finally, another application for using CVC techniques revolves around confirming specific chart patterns such as double tops or head-and-shoulders formations occurring alongside specific price trends allowing crypto traders to make informed trading decisions through insights provided by this method. To excel at crypto trading requires analyzing volume data; providing valuable insight to gauge market mood swings, liquidity changes & pricing strength.

Adding Cumulative Volume Delta (CVD) to your arsenal enhances analyzing with a full perception on buying & selling pressure trends available. Trading with effective use of CVD allows detection for potential trend reversals & market divergences while validating patterns which establish a notable competitive edge against competitors within the same field! Embrace integration of thorough use with CVD enabling deeper understanding of complex movements within this fast-paced realm.