Choosing the Right Cryptocurrency Wallet: A Comprehensive Guide

Welcome to our all-inclusive guide on how you can find the best crypto-wallet that fits uniquely into managing investments in digital assets like cryptocurrencies. In this blog, we will provide insights into various categories of wallets, factors to consider when making your selection and practical wallet-security tips ensure a worry-free experience. Stay with us!

The Different Types of Wallets

- Hardware Wallets: Hardware wallets offer advanced-level security features as they store cryptocurrencies offline in physical devices. Trezor, Ledger, and KeepKey are popular examples.

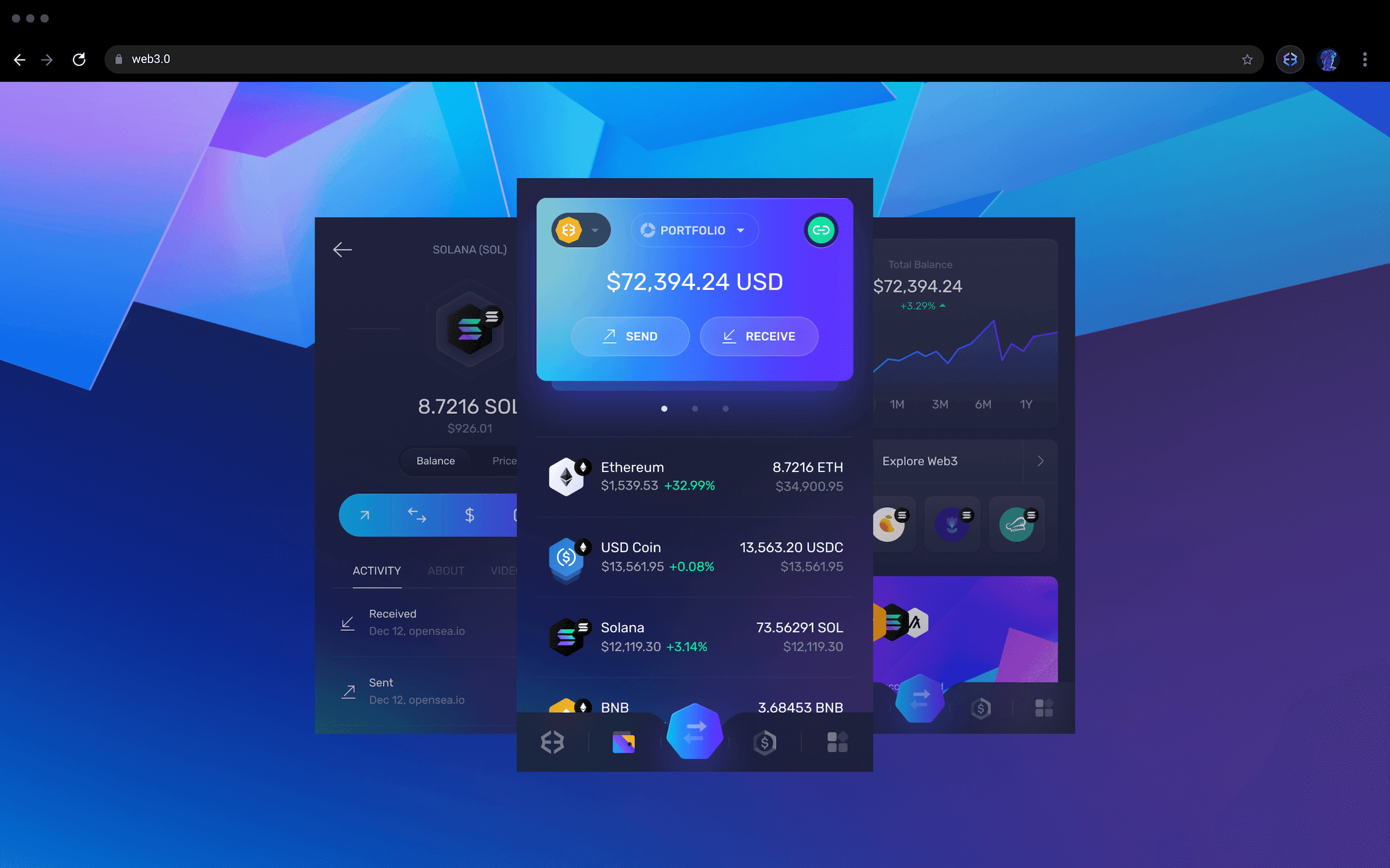

- Software Wallets: Software wallets are user-friendly applications installed on mobile devices or computers that enable quick access to digital assets while maintaining a balance between usability and security. Examples of software wallets are Exodus, Atomic Wallet, and Trust Wallet.

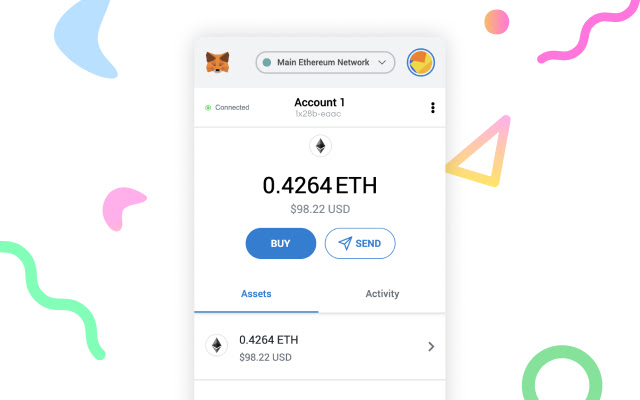

- Online Wallets: Online wallets come in handy if you need quick access to your digital assets right from the browser. However, their internet connections make them vulnerable to cyber-attacks leading to potential devastating losses. Popular examples include MetaMask, MyEtherWallet and Coinbase Wallet.

What To Consider When Choosing A Cryptocurrency Wallet:

The following are crucial factors that you need to look out for when selecting an ideal cryptocurrency wallet:

- Security Features: Choose crypto-wallets with robust security measures such as encryption protocols that minimise the chances of getting compromised –this also includes two-factor authentication or backup options for added protection.

- Supported Digital Assets: It's imperative you get a wallet chosen based on supported cryptocurrencies; only find options best-fit along lines with your long-term investment goals rather than making hasty decisions based on immediate price volatility.

- User Experience: Digital asset management ease is paramount thus choosing cryptocurrency management platforms with intuitive interfaces which incorporate easy navigation can significantly reduce human errors in the click-animation process.

- Reputation of the Investment Community: To evaluate the trustworthiness of any platform functionality –it's necessary to research within forums or Reddit groups about your preferred crypto-wallet– peer reviews often matter significantly when it comes down to commitment time within a platform.

- Development Team behind the Platform: Only opt for established development teams with a proven track record in providing regular security updates, and future support for top-notch maintenance of any platform applications while also showing clear intentions for more updates in the future.

Implementing Best Crypto-Wallet Security Practices:

Essential tips that you should observe are:

- Use unique passwords with different combinations as similar login credentials expose your investments across various platforms. - Enable two-factor authentication where possible to add an extra layer of security

- Regular software updates provide fixes to non-real-time vulnerabilities found by developers which can harm your investment or lead to theft when exploited. It is highly recommended that you backup your wallet's recovery phrase or private keys and store them in a safe location. To prevent any phishing attempts, only download wallets from official sources and remain cautious. When dealing with cryptocurrency-related activities, consider using a dedicated computer or device.

Let's look at some examples of wallets available in the market:

- Ledger is an excellent cold wallet that stores a vast range of cryptocurrencies. It provides an offline storage option that is chip-secured and comes with an easy-to-navigate interface.

- Trust Wallet is a user-friendly mobile wallet that supports several cryptocurrencies and decentralized applications (DApps). Managing digital assets on the go has never been easier.

- The Exodus software wallet facilitates seamless management of multiple digital assets, supporting various cryptocurrencies and even offering integrated exchange options for traders.

- MetaMask serves as an online web wallet that offers Ethereum support tailored for use with decentralized applications on web browsers. It's equipped with intuitive features enabling users to manage their decentralized resources effortlessly.

Several wallets offer integration with Decentralized finance (DeFi) platforms which provide more functionality such as smart-contracts, liquidity pools participation, etc. Some examples of wallets offering DeFi integration are MetaMask, Trust Wallet & MyEtherWallet.

Leveraging Your Capital While Keeping Your Funds Safe:

For traders, leveraging capital can be an effective strategy. By keeping a portion of your funds in cold storage for long-term security and using the remaining funds on exchanges with leverage, you can amplify your trading positions. Let's consider a scenario where one owns Bitcoin valued at $10,000. To guarantee the security and durability of their investment over the long term period; they may decide that retaining 90% or $9,000 worth of Bitcoin is prudent using a hardware wallet method. The remaining percentage (10%) which equals $1,000 can be placed with a reputable exchange for taking advantage of leveraged trading opportunities. A balance of keeping such funds with an exchange implies that leveraging facilitates amplified trading positions leading to greater profit margins which includes utilizing trading capital multiple times over ten times. Therefore turning an amount like $1,000 into what could be considered as $10,000 in buying power. However, it's important to understand the risks involved in leveraging and to have proper knowledge and risk management before attempting such strategies.

In conclusion, it's critical to choose the right type of crypto-wallet to secure your digital assets adequately while efficiently managing your portfolio. Explore different wallet types in the market, pay attention to critical factors such as security & privacy features; Furthermore, deploy measures to control risk when investing in cryptocurrency markets leveraging opportunities associated with De-Fi integration wisely.

Discover all the possibilities presented by cryptocurrencies with a reliable wallet tailored towards safeguarding your investments while allowing you to make discerned choices. Kindly note however that this blog post provides purely educational and informative content without offering any form of monetary guidance or advice.it's crucial to conduct thorough individual research along with expert consultations before taking part in any acts of investing.